The Gnome Project (Cobalt / Zinc), 100% owned by AsiaBaseMetals Inc., encompassing 5,868 hectares (12 mineral claims) in the heart of an area that is home to both the Cirque and the Cardiac Creek Deposits, is located 35 kilometers SE along trend from Teck Resources Limited ("Teck") & Korea Zinc's joint ventured ("T-KZ-JV" - 50% each) Cirque deposit and 15 kilometers south east from the Cardiac Creek deposit (ZincX Resources Inc.). The Cirque deposit, the Cardiac Creek deposit, Pie, Cirque East and Youen properties, the Cirque Property and the Gnome property are all in the same geological belt, NE of Williston Lake, in north western British Columbia, Canada, within a north-northwest-south-southeast-oriented geological trend in the southernmost part (Kechika Trough) of the regionally extensive Paleozoic Selwyn basin. The Selwyn basin is already recognized as one of the most prolific sedimentary basins in the world for the occurence of sedex zinc-lead-silver and strataform barite deposits discovered in the heyday of northern B.C., Canada, Pb-Zn-Ag exploration (late 1970's and early 1980's).

The Gnome Project (Cobalt / Zinc), 100% owned by AsiaBaseMetals Inc., encompassing 5,868 hectares (12 mineral claims) in the heart of an area that is home to both the Cirque and the Cardiac Creek Deposits, is located 35 kilometers SE along trend from Teck Resources Limited ("Teck") & Korea Zinc's joint ventured ("T-KZ-JV" - 50% each) Cirque deposit and 15 kilometers south east from the Cardiac Creek deposit (ZincX Resources Inc.). The Cirque deposit, the Cardiac Creek deposit, Pie, Cirque East and Youen properties, the Cirque Property and the Gnome property are all in the same geological belt, NE of Williston Lake, in north western British Columbia, Canada, within a north-northwest-south-southeast-oriented geological trend in the southernmost part (Kechika Trough) of the regionally extensive Paleozoic Selwyn basin. The Selwyn basin is already recognized as one of the most prolific sedimentary basins in the world for the occurence of sedex zinc-lead-silver and strataform barite deposits discovered in the heyday of northern B.C., Canada, Pb-Zn-Ag exploration (late 1970's and early 1980's).

Highlights of 2019 eight soil and 12 rock samples results from Area G:

Soil Sample Results – Highlights (Table - 1 - below):

Rock Sample Results - Highlights (Table - 2 - below):

Grab rock samples results indicate cobalt values in the range of 0.8 ppm to 725.5 ppm (0.07%) Co, zinc 56.9 ppm to 17,707 ppm (1.77%) Zn, nickel 1.9 ppm to 1,988.2 ppm (0.19%) Ni, Manganese 22 ppm to over 12,653 ppm (1.26%) Mn and iron 0.28% to over 40% Fe.

The 2019 exploration program also included the drilling of one 140m hole (true depth of 80m) (Azimuth 270, dip -50, location: 6345164N, 406023E on NAD 83 Zone 10) to test for shallow targets in Area C. Although the drill hole intersected favourable lithological unit of Gunsteel Formation comprising of grey to black carbonaceous shales with 1-3% sulphides, the assay results indicated no significant anomalous values of target metals.

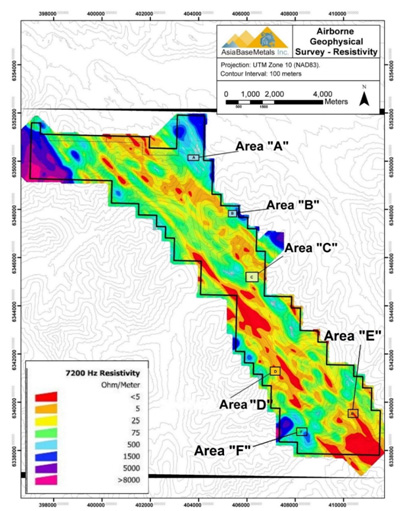

With the inclusion of Area G, seven potential target areas to date have been identified on the property where topsoil has shown limonitic and hematitic alteration with high nickel, cobalt, manganese and zinc mineralization (see Figure 1). The Company has drill tested only Area C and believes exploration on the other six areas is warranted.

Figure -1: Exploration Areas – A, B, C, D, E, F & G

Raj Chowdhry, the founding director, Chairman, CEO and President stated, “Although drilling results did not meet our expectations of identifying a shallow mineralization possibly amenable to open pit mining, the discovery of a new target area and the remaining targets in other areas identified to date on the Gnome property continue to present a good chance of a discovery for cobalt and zinc at shallow or deeper depths. The Company intends to advance this project in congruence with market conditions. ”

Quality Assurance and Quality Control (QA/QC).

A total of 8 soil samples and 12 grab rock samples were collected from newly discovered target Area G in the 2019 exploration program. This sampling also included 10% duplicates as part of Quality Assurance and Quality Control (QA/QC) program. All samples and drill hole were recorded as to location (UTM - NAD 83), sample type (grab, composite grab, chip, soil, silt etc.), exposure type (outcrop, subcrop, float, etc.), lithology, colour, texture and grain size. For the Soil Sampling work, conventional soil samples were collected from the B-horizon (being generally below vegetation) wherever possible. All rock samples were grab samples taken from outcrops. For drill hole GN19-01, the core boxes were brought at Akie Camp where all core was logged for lithology, structure, mineralization, percent core recovery and RQD. A total of 87 core samples were collected by splitting one-meter core length at a time using rock saw where one half was put in sample bag, and the other half was retained in the core box. All samples were shipped to ACME Analytical Laboratories (Bureau Veritas) in Vancouver. The samples were assayed using laboratory analytical codes: AQ252-EXT for rock samples, and AQ252 for soil samples. Samples found to be over limit to the laboratory’s method for zinc and manganese were re-assayed using laboratory’s method MA270). The Company cautions that grab samples are selected samples and are not necessarily representative of the mineralization hosted on the property.

With the inclusion of Area G, seven potential target areas to date have been identified on the property where topsoil has shown limonitic and hematitic alteration with high nickel, cobalt, manganese and zinc mineralization (see Figure 1). The Company has drill tested only Area C and believes exploration on the other six areas is warranted.

Discovery of Cobalt (Co) - Gnome Project

First in the region, together with Zinc.

Soil Geochemical Survey Results - 2018

Anomolous Cobalt (0.58% Co) together with Zinc (up to 5.99% Zn) and Manganese (up to 10.6% Mn)

(see Corporate Presentation / Company's News Release Oct 29, 2018)

| Cobalt (Co) | Zinc (Zn) | Manganese (Mn) | Nickel (Ni) | Iron (Fe) |

| 0.58% | 5.99% | 10.62% | 0.8% | 58.4% |

Highlights of Soil & Rock Samples Analytical Results (2018) –Table 1 & Table 2

Table 1: Highlights of Soil Samples Analytical Results – Gnome Project (AsiaBaseMetals Inc.)

| Sample ID | Location NAD 83 Zone 10 | Area | Method | AQ252 / MA270 | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Analyte | Mo | Cu | Zn | Ag | Ni | Co | Mn | Fe | Ba | |||||||||||||||||||

| Unit | PPM | PPM | PPM | PPB | PPM | PPM | PPM | % | PPM | |||||||||||||||||||

| MDL | 0.01 | 0.01 | 0.1 | 2 | 0.1 | 0.1 | 1 | 0.01 | 0.5 | |||||||||||||||||||

| Easting | Northing | Type | , | |||||||||||||||||||||||||

| GN18-001 S | 407110 | 6337869 | F | Soil | 3.15 | 2.95 | 26260 | 28 | 8256 | 5812 | 106223 | 33.5 | 475.6 | |||||||||||||||

| GN18-002 S | 407123 | 6337844 | F | Soil | 42.83 | 7.31 | 9609 | 95 | 632.4 | 147 | 817 | 48.31 | 167.6 | |||||||||||||||

| GN18-050 S | 410366 | 6339314 | E | Soil | 39.34 | 45.74 | 56010 | 113 | 4294 | 803 | 29048 | 32.6 | 320 | |||||||||||||||

| GN18-051 S | 410366 | 6339314 | E | Soil | 32.96 | 44.37 | 59908 | 80 | 4371 | 826 | 30223 | 32.78 | 317.2 | |||||||||||||||

| GN18-055 S | 410389 | 6339298 | E | Soil | 147.4 | 55.02 | 23584 | 326 | 3359 | 550 | 16665 | 27.53 | 439.2 | |||||||||||||||

| GN18-056 S | 410359 | 6339299 | E | Soil | 53.99 | 40.21 | 32321 | 396 | 2979 | 491 | 16051 | 22.45 | 395.5 | |||||||||||||||

| GN18-106 S | 407445 | 6341612 | D | Soil | 5.78 | 4.02 | 8509 | 98 | 2410 | 1980 | 28414 | 43.16 | 399.5 | |||||||||||||||

| GN18-108 S | 407442 | 6341588 | D | Soil | 11.52 | 6.96 | 10789 | 96 | 3917 | 2033 | 43291 | 39.18 | 812.6 | |||||||||||||||

| GN18-109 S | 407459 | 6341590 | D | Soil | 6.47 | 3.04 | 9314 | 79 | 2952 | 2148 | 32624 | 43.03 | 638.4 | |||||||||||||||

| GN18-110 S | 407481 | 6341597 | D | Soil | 8.66 | 14.02 | 5136 | 220 | 1773 | 1959 | 35659 | 38.51 | 748.5 | |||||||||||||||

| GN18-111 S | 407491 | 6341602 | D | Soil | 8.36 | 43.57 | 5666 | 601 | 1877 | 1451 | 29382 | 35.82 | 938.8 | |||||||||||||||

| GN18-112 S | 407491 | 6341602 | D | Soil | 8.34 | 46.41 | 5649 | 639 | 1862 | 1534 | 30213 | 35.23 | 948.6 | |||||||||||||||

| GN18-113 S | 407502 | 6341575 | D | Soil | 3.79 | 10.63 | 5212 | 164 | 2141 | 2113 | 44377 | 39.11 | 800.4 | |||||||||||||||

| GN18-115 S | 407455 | 6341569 | D | Soil | 11.31 | 3.11 | 10994 | 67 | 3692 | 2185 | 40220 | 41.94 | 725.5 | |||||||||||||||

| GN18-117 S | 407501 | 6341536 | D | Soil | 5.79 | 13.83 | 12339 | 136 | 4204 | 3234 | 60582 | 38.67 | 1315.5 | |||||||||||||||

| GN18-118 S | 406042 | 6345118 | C | Soil | 41.7 | 8.62 | 28374 | 171 | 2515 | 1926 | 38126 | 40.34 | 444.1 | |||||||||||||||

| GN18-119 S | 405973 | 6345173 | C | Soil | 33.47 | 91.48 | 4112 | 3109 | 552.3 | 1265 | 18519 | 37.55 | 488.1 | |||||||||||||||

| GN18-120 S | 406098 | 6345036 | C | Soil | 109.2 | 18.62 | 17752 | 1914 | 2237 | 1817 | 36315 | 30.71 | 677.8 | |||||||||||||||

| GN18-121 S | 406097 | 6345060 | C | Soil | 89.29 | 21.51 | 10596 | 2326 | 1670 | 1276 | 28757 | 18.27 | 4094.6 | |||||||||||||||

| GN18-123 Set | 406062 | 6345097 | C | Soil | 74.22 | 19.79 | 15954 | 1482 | 1801 | 1372 | 25423 | 36.17 | 2314.5 | |||||||||||||||

Click here to see all of the soil sample results for 2018.

Table 2: Highlights of Rock Samples Analytical Results– Gnome Project (AsiaBaseMetals Inc.)

| Sample ID | Sample Location NAD 83 Zone 10 V | Area | Method | AQ252 | |||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Analyte | Mo | Cu | Zn | Ag | Ni | Co | Mn | Fe | Ba | ||||||||||||||||||||

| Unit | PPM | PPM | PPM | PPB | PPM | PPM | PPM | % | PPM | ||||||||||||||||||||

| MDL | 0.01 | 0.01 | 0.1 | 2 | 0.1 | 0.1 | 1 | 0.01 | 0.5 | ||||||||||||||||||||

| Easting | Northing | Type | |||||||||||||||||||||||||||

| GN18-002 R | 407116 | 6337849 | F | Rock | 174.18 | 21.2 | 4378.7 | 98 | 210.2 | 22.8 | 231 | >40.00 | 136.2 | ||||||||||||||||

| GN18-003 R | 407123 | 6337844 | F | Rock | 32.03 | 23.73 | 4659.3 | 136 | 293.3 | 30.3 | 128 | 38.68 | 153.8 | ||||||||||||||||

| GN18-015 R | 407358 | 6341749 | D | Rock | 6.31 | 420.73 | 1917.1 | 25 | 82.5 | 6.7 | 73 | >40.00 | 1 | ||||||||||||||||

| GN18-025 R | 407439 | 6341617 | D | Rock | 6.27 | 2.21 | 6824.6 | 22 | 169.4 | 30.7 | 210 | >40.00 | 11.1 | ||||||||||||||||

| GN18-026 R | 407481 | 6341597 | D | Rock | 22.49 | 3.78 | 5821.5 | 56 | 819.9 | 808.3 | >10000 | >40.00 | 322 | ||||||||||||||||

| GN18-029 R | 407437 | 6341625 | D | Rock | 9.69 | 1.73 | 9839.5 | 16 | 654.2 | 412.6 | 5396 | >40.00 | 63.8 | ||||||||||||||||

| GN18-030 R | 407437 | 6341625 | C | Rock | 15.33 | 2.08 | 6606.7 | 21 | 206.8 | 43.7 | 342 | >40.00 | 22.5 | ||||||||||||||||

Click here to see all of the rock sample results for 2018.

Significant Zinc properties in the Gnome Property area:

Note 1:There can be no assurance that the Company will obtain similar results on the Gnome Property. The PEA is considered preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. Mineral resources that are not mineral reserves have not yet demonstrated economic viability. Due to the uncertainty that may be attached to mineral resources, it cannot be assumed that all or any part of a mineral resource will be upgraded to mineral reserves. Therefore, there is no certainty that the results concluded in the PEA will be realized. Mineralization hosted on the Cirque and Cardiac Creek Properties is not indicative of the mineralization hosted on the Company’s Gnome Zinc Project at its current stage of exploration.

Exploration History - in the area:

In December 1992, Curragh Resources, which had previously acquired Cirque, was issued a Mine Development Certificate (approval for construction) by the BC Government for a mine/mill complex with a daily milling rate of 3,500 tonnes. The company estimated that the project would produce about 250,000 tonnes of zinc and lead sulphide concentrates yearly.

Historic drilling delineated historical estimates of the North Cirque zone and South Cirque zone. Development of Cirque did not proceed and the property was subsequently acquired by Teck Corporation (25%), Cominco Limited (25%) and Korea Zinc Company (50%) under a joint venture (Sources: Assessment report 34274, dated November 1, 2013; Ministry of Energy and Mines MINFILE Number: 094F 008; website - Canada Zinc Metals Corp.)

Note: "Qualified Person" information is provided, as required by regulatory authorities, in the "Disclaimer" section of this website under the heading "Technical Information".